Water Damage Coverage by Your Insurance Company

12/13/2021 (Permalink)

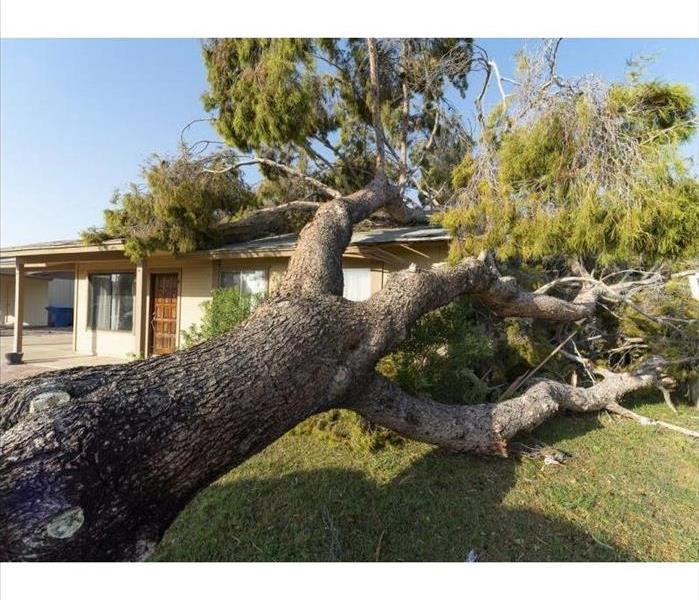

Water damage caused by extreme weather conditions such as wind causing a tree to fall on top this house is generally covered by your insurance.

Water damage caused by extreme weather conditions such as wind causing a tree to fall on top this house is generally covered by your insurance.

Understanding what type of water damage is covered by your insurance is important. That way, you can get a better of understanding of your expenses when dealing with water damage and be more conscious of preventative measures. In general, water damage coverage is determined by the amount of maintenance and upkeep in a home and whether or not the water damage was accidental or not. We’ll talk more about that later. First off, let’s introduce the different types of water damage.

Categories of Water Damage

Clean Water: This type of water damage is usually immediate and can result from a leaking pipe. It is usually low risk if dealt with on the spot. If the water is exposed for too long the water can become contaminated leading us to the second category of water damage.

Grey Water: Grey water is usually associated with water that is contaminated and its source is most often from leaking appliances such as dishwashers. This type of water usually contains chemicals such as dishwasher fluid and can pose risks for one’s family.

Black water: Black water is the most harmful type of water damage and is usually associated with the sewer water. This type of water usually contains oils, urine and toxic waste. The water can foster growth for bacteria, viruses, and allergens. Being exposed to black water can almost certainly affect an individual with an illness or an infection 90% of the time.

Water damage coverage by your insurance company

What is covered

As stated above, water damage coverage is usually determined by a matter of responsible upkeep and maintenance of your home and appliances. Negligence is largely factored into water damage coverage. If the water damage is sudden and completely accidental such as a bursting pipe, then it is most likely that the water damage will be covered. Water damage that occurs from water getting into your home from extreme weather conditions, such as a tree or ice dam falling on top of your home and leaving exposures will be covered by water damage. When water enters your home through a leaking roof, you may or may not be covered depending on how gradual the water damage was and maintenance of the roof.

What is not covered

One instance of damage that will not be covered is improper maintenance. For example, if you have water damage to your home while being aware of a leaking pipe and using tape as a fixture, then you will not be covered. There is also another weird concept when it comes to water damage coverage. Water damage where the source of water is external and has touched the ground will not be covered in your homeowner’s insurance. This can involve water damage from a sewage backup or rainwater that results in a flood. However, there are separate types of insurances for these situations.

What to do in the event of water damage

- When you first notice any instances of water damage, call your insurance company before attempting to make repairs. That way you have an estimate of your coverage before you start making any repairs.

- Gather as much proof as you can of any water damage in your home. This way you will have the most coverage you can possible and also is less problematic for the insurance company

- Gather water damaged valuables and belongings to provide as proof of water damage for further coverage.

- Call a cleanup and restoration vendor. Usually, your insurance company will refer you to a vendor but you can do your own research to find a reliable vendor such as SERVPRO of Monterey Park.

If you're seeking a reliable cleanup and restoration service, call SERVPRO of Monterey Park! We have certified professionals that deal with all sorts of water damage.

24/7 Emergency Service

24/7 Emergency Service